Why Choose RV Financing Kunes When Purchasing from Kunes RV

At Kunes RV, financing your RV is simple, stress-free, and tailored to you. Your RV can be financed, allowing you to spread out the cost over time. We offer financing options for both new or used RV purchases.

Our hassle-free pre-qualification lets you verify your creditworthiness without affecting your credit score (soft pull). We partner with a wide network of **banks and credit unions—for all credit types—**and we make the lenders compete so you don’t have to. We also work with a network of participating dealerships to streamline the financing process. Result: you get the best program and payment for your needs and budget, and your dream RV gets a whole lot closer. Plus, you can access great rates through Kunes RV's lender network.

Rates and terms are subject to change and dependent on credit approval.

The Kunes RV Financing Advantage

- Soft-pull pre-qual: check your buying power with zero impact to your score.

- Many lenders, one application: we shop banks + credit unions and bring back the winners.

- All credit welcome: first-time buyers, rebuilding credit, or stellar scores—we meet you where you are.

- Borrower's credit score matters: your credit score, including meeting the minimum credit score requirement (usually around 600), affects eligibility and loan terms.

- Lower credit score? A lower credit score may result in higher interest rates or different financing terms.

- RV loans require: certain documentation and criteria, such as proof of income and a minimum credit score.

- Payments that fit: total loan amount and financing terms are customized to fit your needs and monthly comfort zone.

- Transparent math: clear out-the-door price, taxes/fees, and no mystery add-ons.

How It Works

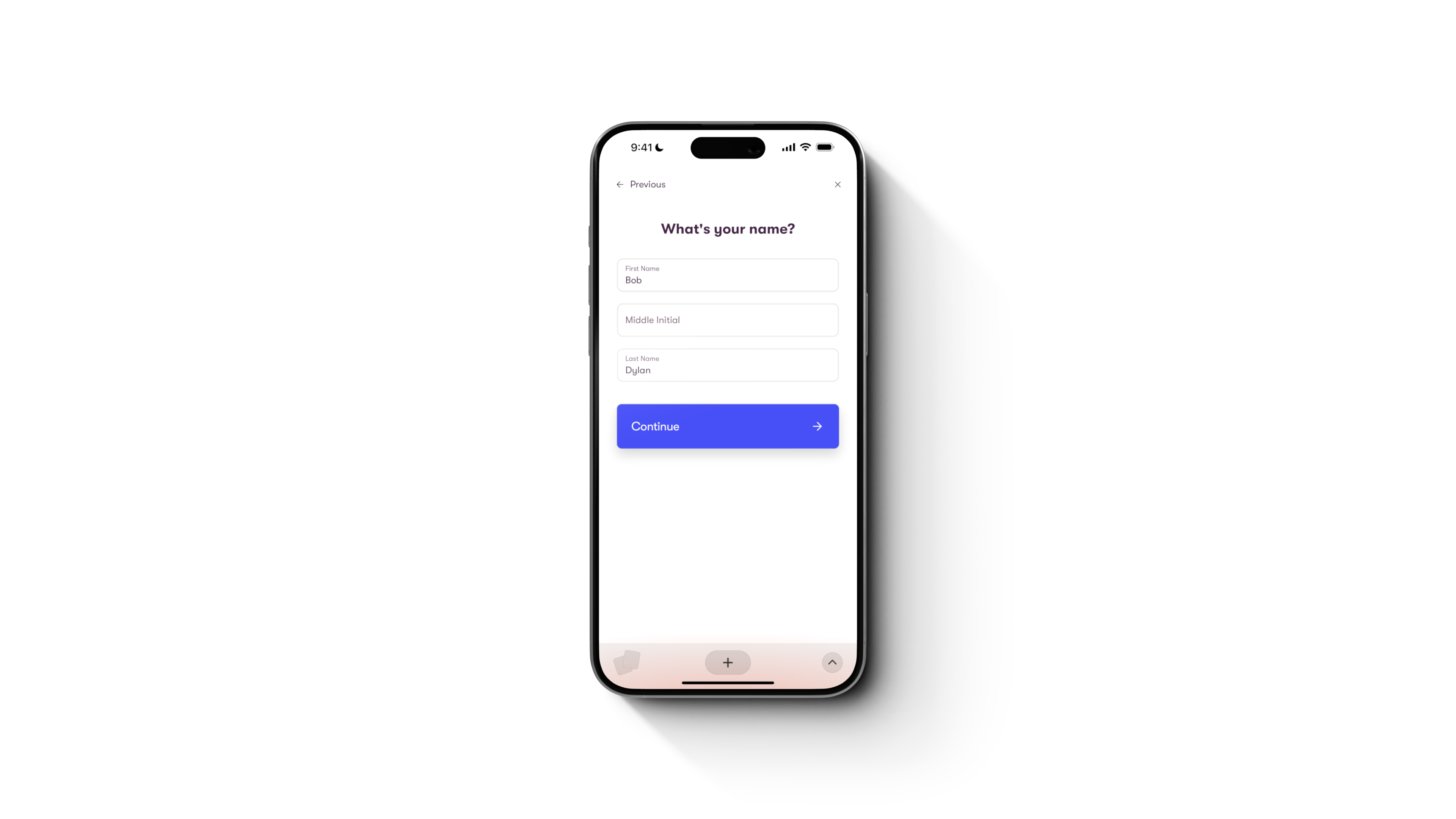

- Pre-qualify with a soft pull—see rate & payment ranges up front. The process begins with application submission, which can be completed online or in person.

- Pick your RV (travel trailer, fifth wheel, toy hauler, motorhome). You can work directly with a dealer to finalize your purchase and financing.

- We shop lenders and negotiate on your behalf. The RV you select will serve as collateral for the loan.

- Choose your plan (best rate vs. lowest payment vs. shortest term).

- Sign & camp—most customers wrap up in a single visit.

Pro tip: have your trade-in, payoff info, and two keys handy—more equity = lower payment.

Understanding RV Loan Rates

When it comes to RV financing, understanding RV loan rates is key to making a smart purchase. RV loan rates directly influence your monthly payment and the total amount you’ll pay over the life of your loan. These rates can vary depending on several factors, including your credit score, the loan term you choose, and current market conditions. Generally, a higher credit score can help you qualify for lower RV loan rates, which means lower monthly payments and significant savings in the long run. RV loan rates can range anywhere from 4% to 12% or more, depending on the lender and your financial situation. That’s why it’s important to compare offers from different lenders and find the rate that best fits your needs. By doing your homework and understanding how RV loan rates work, you can secure a loan that keeps your payments manageable and helps you save money over time.

Programs for Real Life

- Zero-/Low-Down Options (on approved credit)

- Flexible Financing Options: Choose from a range of loans and payment plans to fit your budget and needs.

- Longer Terms for budget-friendly payments

- Rate-Focused Plans if you’ll pay it off faster

- Accessory Roll-In: hitch, WDH/sway, backup camera, solar, batteries—add what you need now, one payment

- Total Loan Bundling: Bundle your total loan amount, including accessories and protection plans, for added convenience.

- Refinancing Available: Improve your existing RV loan terms or interest rates with refinancing options.

- Protection Plans (tire/wheel, service contracts, GAP) explained plainly—opt-in, not pressured

Why Finance vs. Pay Cash?

- Keep your emergency fund intact for the unexpected.

- Build credit with on-time payments.

- Inflation hedge: enjoy the RV now while paying predictable monthly amounts.

- Opportunity cost: your cash can keep earning elsewhere.

- Flexible financing for RV purchases: Financing is available for a wide range of RV purchases, including both new and used models, helping buyers meet their unique recreational needs.

Payment Math

- Start with the out-the-door price.

- Subtract trade-in / cash down.

- The total loan amount is calculated by subtracting your down payment and trade-in from the purchase price, then adding any accessories or protection plans.

- Choose your term (shorter = less interest; longer = lower monthly). The model year of your RV can influence the maximum loan term and eligibility.

- Add approved annual percentage rate (APR), which is used to calculate your monthly payment and is based on your credit approval.

- Use these figures to calculate your estimated monthly payment.

Using a Loan Calculator

A loan calculator is an essential tool for anyone considering an RV loan. With just a few details—like the purchase price, down payment, loan term, and interest rate—you can quickly estimate your monthly payment and see how different loan options stack up. By entering your numbers into a loan calculator, you’ll get an estimated monthly payment based on your chosen loan amount and terms. This helps you determine how much RV you can comfortably afford and plan your financing accordingly. You can also use the calculator to see how changing your down payment or adjusting the loan term affects your payment, making it easier to compare different loan options and interest rates. Using a loan calculator puts you in control, helping you make informed decisions and ensuring your RV purchase fits your budget.

For Every Camping Style

- Weekend campers: small down, longer term → easy monthly.

- Full-timers: rate-focused, add solar/lithium & extended service for peace of mind.

- Toy haulers & tow rigs: bundle hitch/suspension upgrades so departure day is drama-free.

- First-timers: soft-pull pre-qual + new-owner orientation = stress off your shoulders.

- Financing is available for all types of recreational vehicles, including Class A motorhomes, travel trailers, and RVs with living quarters.

- Kunes RV can help you find the perfect RV to match your camping style and budget.

Pre Approval Process

Getting pre-approved for an RV loan is a smart first step in the buying process. The pre-approval process starts with submitting a loan application and providing details about your credit history, income, and employment. The lender will review your financial situation and credit score to determine your qualification amount and then provide a pre-approval. This pre-approval gives you a clear idea of your budget and strengthens your negotiating position when discussing the purchase price of your RV. Borrowers with a higher credit score and stable finances are more likely to be pre-approved for a larger loan amount and better terms. The process can be completed online, in person, or over the phone, and typically takes just a few days. With pre-approval in hand, you can shop for your RV with confidence, knowing exactly what you can afford.

Loan Terms and Conditions

Before finalizing your RV loan, it’s important to understand the loan terms and conditions. RV loan terms can range from 10 to 20 years, and the length of your loan term will affect both your monthly payment and the total interest paid over time. Longer loan terms usually mean lower monthly payments, but you’ll pay more in interest overall. The loan agreement will outline your interest rate, loan amount, monthly payments, and any additional fees or charges. Be sure to review these details carefully and consider your debt-to-income ratio to ensure your payments are manageable. Also, check if there are any prepayment penalties, which could impact your ability to pay off the loan early and save on interest. Understanding your loan terms and conditions helps you make informed decisions and avoid surprises down the road.

Making a Down Payment

Making a down payment on your RV loan is a great way to reduce your loan amount and lower your monthly payment. Typically, down payments range from 10% to 20% of the purchase price, but putting more down can help you qualify for better loan terms and lower interest rates. If you have lower credit scores, a larger down payment may be required to secure financing. Down payments can be made in cash or by trading in your current vehicle. It’s also important to factor in closing costs, such as title insurance, registration, and other fees, when planning your purchase. By making a solid down payment and reviewing your loan terms, you can save money over the life of your loan and enjoy a smoother RV financing experience.

Credit Concerns? We’ve Got You.

- Rebuilding credit: show steady income = real options, even if you have bad credit—though you may face higher interest rates, alternative financing like credit unions or owner financing can help.

- Thin file/new to credit: co-signer choices and short terms to establish history; improving your credit can help you qualify for a lower interest rate on your RV loan.

- Past hiccups: down-payment strategies + lender matches that understand RV buyers.

What to Bring

- Valid ID

- Proof of income (recent pay stubs or award letters)

- Insurance info (RV insurance is required to protect your vehicle and is an important part of the financing process; we’ll help if you need a policy)

FAQs

Does pre-qualification ding my credit?

No—the initial check is a soft pull.

Can I finance accessories and protections?

Yes—roll qualified items into one payment.

Fixed or variable rates?

Most programs are fixed-rate for predictable payments.

Early payoff penalties?

Many lenders have no prepayment penalty—ask and we’ll match you accordingly.

I’m shopping rates at my bank—okay?

Absolutely. Bring your quote—we’ll try to beat or match it and keep everything in one stop.

Does Kunes RV offer an RV loan calculator?

Yes, we provide an RV loan calculator to help you estimate monthly payments, compare loan options, and determine affordability before purchasing.

Can I finance a used RV or a new RV?

Yes, financing is available for both used RVs and new RVs. We offer competitive rates and flexible terms for pre-owned and recently purchased recreational vehicles.

What is the typical RV loan range for term lengths?

RV loans range from short-term options to long-term financing, often up to 20 years, depending on your needs and the RV you choose.

What is the application submission process for an RV loan?

Our application submission process is quick and streamlined. You can submit your application online with minimal paperwork, and we’ll guide you through the next steps toward approval.

Can I refinance my existing RV loan?

Yes, refinancing is available for existing RV loans. Refinancing can help you secure a lower interest rate, reduce monthly payments, or adjust your loan terms for better financial flexibility.